Equine liability insurance options can seem daunting, but whether you own a boarding barn or keep horses in your back yard, they’re necessary to keep you safe from legal action. And even if you don’t own a farm, carrying some form of equine liability insurance may help keep you safe lawsuits. Read on to find out why.

By Sarah E Coleman

Investigating insurance of any kind can be overwhelming, whether you’re looking at health insurance, life insurance, truck and trailer insurance or equine insurance. And as equine insurance is something many horse enthusiasts feel they don’t have to have, it can easily fall by the wayside (it can be hard enough to remember to renew our equine association memberships at the end of the year!).

However, being uninsured or under-insured can be even scarier: The thought of losing your farm, your home, your horses and most of your assets is enough to make any horse owner quiver in their muck boots. While you may feel that your clients are stand-up people who wouldn’t sue you, it’s important to remember that many times, the injured do not have an option in whether or not legal action is taken—their insurance company makes that call.

So, what insurance is best for you?

Liability Insurance: Who Needs it?

Sadly, in the litigious world we now live in, having liability insurance is more than just peace of mind--it can be key to protecting yourself and your assets should you be brought to court.

One term of importance, says Kristin Detwiler, an agribusiness and equine specialist with Gibson Agri & Equine Insurance in Girard, Ohio, is to make sure you’re working with someone who truly understands the equine operation and what needs to be covered.

For example, some home owner’s insurance policies will cover the liability for a few horses kept in the backyard, but will not cover someone who owns a large farm with boarded horses (owned by other people) on the property. For those people who board horses, they need a different policy: a farmowner’s insurance policy.

The easiest way to tell what type of insurance you need is to ask yourself this question: Is someone making a profit from this operation? If they are, this becomes a "commercial" exposure and a commercial farm policy would be needed, as opposed to a personal policy (meaning you make your income elsewhere).

Insurance Options

There are many different types of liability insurance, but agribusiness and farm owner’s policies are typically what is used to cover a farm property and the liability that comes with it, notes Detwiler. Each liability policy is then tailored to the individual based on their needs and their operations.

For example, the liability insurance a boarding barn owner carries will be different from that carried by a trainer who travels to various farms to give lessons, but insurance is necessary for both. What differs for each is what is specifically covered under each policy.

The most popular liability insurance options for those involved in the equine industry are Equine Personal Liability and Equine Professional Liability.

EQUINE PERSONAL LIABILITY

Generally speaking, for someone who just owns a few pleasure horses in their backyard, equine personal liability would be a good fit, explains Detwiler. This type of policy would include coverage for things like damage to another person or to another person’s property. Equine personal liability insurance would cover episodes like a horse getting into the road and then getting hit by a car, damaging the car or injuring the people in the car.

EQUINE PROFESSIONAL LIABILITY

A more-specific policy targeted to professionals in the equine industry, an equine professional liability policy also covers those who may not own a farm or barn from which they provides these services.

COMMERCIAL FARM OWNER’S PACKAGE

When dealing with equestrian professionals who give riding lessons, board, breed, train, offer clinics, riding camps or something similar, a Commercial Farm Owner’s Package would be a better fit as it could cover all these endeavors. A specific policy would again be tailored to the individual, farm or corporation to cover all of the exposures from their equestrian involvement.

This package insurance policy is the most comprehensive (and often the most affordable) way to cover the entire exposure of the farm to those who may try to sue the farm owner—and it’s done on one policy, says Detwiler.

This policy would cover the actual farm property itself (dwellings, barns, machinery, hay and animals) and provide liability insurance. This liability can include liability for boarding, breeding, training, lessons, clinics and more.

Personal Liability Policy

That being said, stand-alone equine personal liability policies for horse owners who do not own their own farm and aren't covering their liability on a farmowner’s policy are also available. This type of insurance is best suited for horse owners who board or lease a horse that is not housed on property they own.

Some homeowner’s insurance policies will cover the liability from owning a horse, but some will not, so it’s worthwhile to call your current carrier to see if they would extend liability to one owned horse, explains Detwiler.

If your current insurance carrier doesn’t extend coverage, equine personal liability insurance should be considered. These policies are generally very reasonably priced. This policy would provide liability insurance for the horse named in the policy, no matter where it goes. For example, if you were to take your horse to a horse show and the horse bit someone who then tried to sue you, this insurance policy would protect you and your assets.

What is NOT Covered With an Equine Insurance Policy

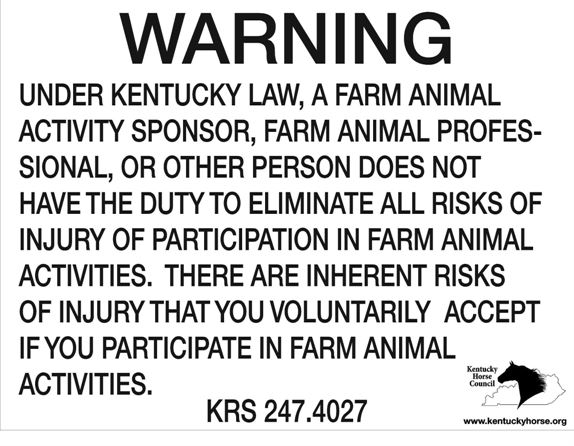

While there is no “blanket” insurance policy, it’s important that any farm with commercial exposure (think boarding, riding lessons, training, etc.) have liability release waivers and hold harmless agreements, which can be drawn up or reviewed by a lawyer. It’s also important that each farm abide by state-specific equine laws, which could include the posting of equine activity awareness signs. (In Kentucky, you can get yours through the Kentucky Horse Council www.kentuckyhorse.org)

“Insurance agencies do not provide such documents,” notes Detwiler. “It is advised that a person meet with an attorney to draft up such paperwork as it will pertain to them and their farm specifically. In writing a commercial farm policy or general liability policy, these waivers are typically required to be used and copies must be sent to the insurance company prior to beginning coverage.”

Insurance in a Nutshell

“If someone owns their own farm, a good catch-all insurance would be an actual farmowner’s policy,” explains Detwiler. “This policy would cover all of the property and the liability based on the liability exposure on the farm itself. For someone who might not own their farm, but is leasing or travels to different barns to give lessons, someone who is doing some boarding, breeding, clinics, or other equine endeavor, a Commercial General Liability policy with equine personal liability and professional liability along with any of the other exposure coverages would be a good catch all.” You could never cover everything on one policy and it can be changed as the exposures change, she notes.

Keeping this in mind, once you have insurance, it’s a good idea to go over your policy each year with your agent when the renewals come due. A lot can change over the course of a year, and you might not think to call your agent every time you offer a new service or hire new employees, but it’s imperative that he or she know exactly what is being done on the farm so they can make sure you’re protected to the very best of the insurance company’s abilities.

It boils down to this: No matter how you are involved in the equine industry, you need to have liability insurance—it depends on what you are doing with the horses that will determine what type of coverage you will need.